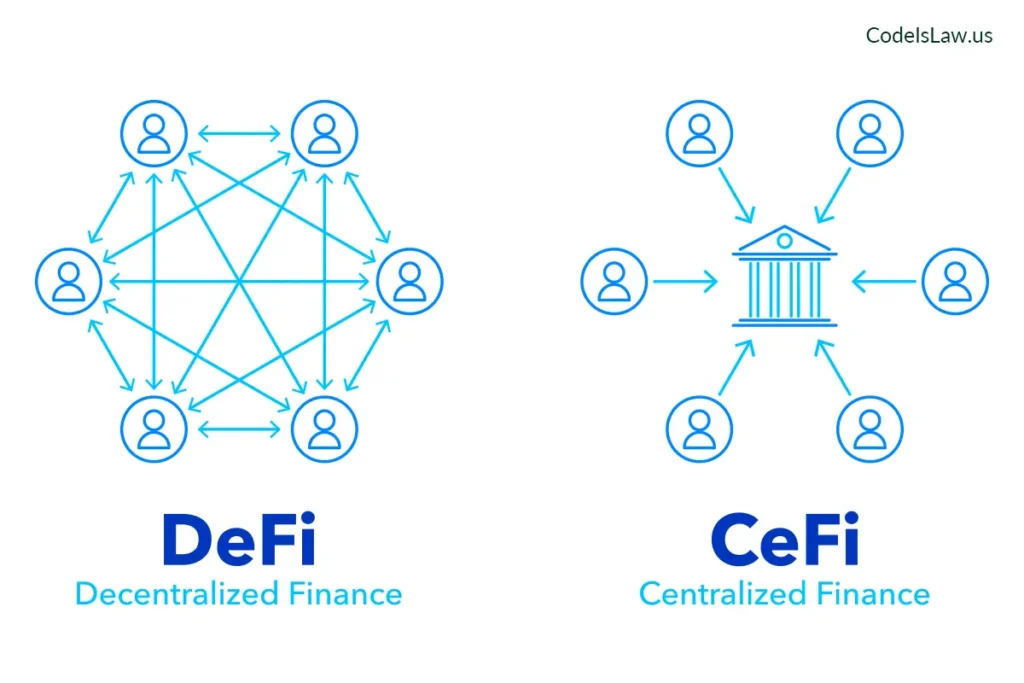

In the last decade, the financial landscape has been undergoing a quiet revolution, and it’s picking up pace faster than ever. At the forefront of this transformation is Decentralized Finance, or DeFi… a new financial ecosystem built on blockchain technology that aims to remove intermediaries like banks and financial institutions. DeFi promises greater access, transparency, and innovation in a space that has long been dominated by large, centralized entities. But what exactly is DeFi, how is it different from traditional banking, and why is it such a game-changer?

In this post, we’ll dive into the future of DeFi, explore its potential to disrupt the traditional banking system, and discuss what this shift could mean for the average consumer and the global financial system as a whole.

What is DeFi?

At its core, Decentralized Finance refers to a collection of financial services and products that run on decentralized blockchain networks like Ethereum. Unlike traditional banking, which relies on centralized entities like banks or payment processors to facilitate transactions, DeFi operates without intermediaries. Instead, smart contracts—self-executing contracts with the terms of the agreement directly written into code—facilitate transactions automatically.

This means that with DeFi, people can:

- Lend or borrow money without needing a bank.

- Trade assets without going through a stock exchange or brokerage firm.

- Earn interest or yields on cryptocurrency holdings, similar to how savings accounts work in traditional banking.

Here’s what makes DeFi so revolutionary:

- Open access: Anyone with an internet connection can participate in DeFi, no matter where they live or who they are.

- Transparency: DeFi platforms are built on public blockchains, meaning all transactions are visible and verifiable, offering a level of transparency that traditional banking systems can’t match.

- Interoperability: DeFi applications (dApps) can seamlessly interact with one another, allowing users to transfer assets across platforms without restrictions or unnecessary friction.

- Permissionless: There are no gatekeepers in DeFi. You don’t need approval from banks or institutions to participate.

How DeFi Works: A Practical Example

Let’s say you want to earn interest on your cryptocurrency holdings. In the traditional banking system, you would deposit money into a savings account, and the bank would lend it out, charging borrowers interest and paying you a small fraction in return.

In DeFi, you can use decentralized lending platforms like Aave or Compound. Here’s how it works:

- You deposit your crypto (like Ethereum or a stablecoin such as USDC) into the platform’s liquidity pool.

- Borrowers can access this pool by posting their own crypto as collateral.

- The smart contract automatically ensures that loans are properly collateralized and that interest payments are distributed to lenders like you.

The whole process happens without a bank, broker, or intermediary. You earn higher interest rates because there’s no middleman taking a cut, and the process is transparent and automated through smart contracts.

Key Areas Where DeFi is Disrupting Traditional Finance

- Lending and Borrowing

In traditional finance, lending involves banks, credit checks, and often lengthy approval processes. DeFi flips this on its head by allowing anyone with crypto assets to participate. Borrowers post collateral, and lenders earn interest through decentralized platforms. DeFi lending doesn’t require credit scores or lengthy paperwork—smart contracts manage everything automatically.

Why it’s disruptive: It democratizes access to financial services, especially for those without access to traditional banks. It also reduces costs and time delays, making it faster and more efficient than traditional lending systems.

- Payments and Remittances

International transfers and remittances are often slow and expensive, with banks and payment processors charging hefty fees for cross-border transactions. DeFi platforms allow for nearly instant global transfers, often at a fraction of the cost, using stablecoins (cryptocurrencies pegged to fiat currencies like USD) to avoid volatility.

Why it’s disruptive: DeFi enables near-instant, low-cost cross-border payments, breaking down barriers and allowing people in emerging markets to participate in the global economy.

- Trading and Exchanges

Traditional stock markets and foreign exchange platforms operate on centralized systems, where brokers or exchanges control the flow of trades and often charge fees for facilitating transactions. In DeFi, decentralized exchanges (DEXs) like Uniswap or SushiSwap allow users to trade tokens directly with one another, using smart contracts to match buyers and sellers.

Why it’s disruptive: It removes middlemen from the trading process, giving users more control over their assets and reducing fees. Additionally, trading can happen 24/7, unlike traditional stock markets with set hours.

- Yield Farming and Staking

In DeFi, users can earn returns by “staking” their crypto or participating in “yield farming.” This involves providing liquidity to a DeFi protocol and earning rewards or interest in return. These yields often far exceed what traditional savings accounts offer, attracting users looking for better returns on their investments.

Why it’s disruptive: DeFi allows people to earn passive income through methods that didn’t exist before in traditional finance. This opens up new ways to grow wealth that are far more accessible than the old systems of bonds, stocks, or savings accounts.

- Insurance

Decentralized insurance protocols, like Nexus Mutual, offer coverage for various risks, from smart contract failures to exchange hacks. Unlike traditional insurance, where companies decide the terms and payouts, DeFi insurance relies on a decentralized pool of participants to decide how claims are handled.

Why it’s disruptive: It offers a more transparent and democratized approach to insurance, with the potential to reduce costs and increase trust in the system.

The Challenges of DeFi

While DeFi has enormous potential, it’s not without challenges. The biggest hurdles include:

- Security Risks: Smart contracts are powerful, but they are only as good as the code they’re written in. Bugs and vulnerabilities can lead to losses, as seen in high-profile DeFi platform hacks.

- Regulation Uncertainty: Many governments are still figuring out how to regulate DeFi. The decentralized nature of these platforms makes them harder to control and monitor, raising concerns over illegal activities like money laundering.

- Scalability: The Ethereum network, which powers most DeFi applications, has struggled with high fees and slow transaction times during periods of heavy usage. Solutions like Ethereum 2.0 and layer 2 scaling technologies are in development to address this.

What Does the Future Hold for DeFi?

The future of DeFi is full of potential, and while it’s still in its early stages, it’s clear that it has the power to revolutionize finance in several key ways:

- Mainstream Adoption: As DeFi platforms become more user-friendly and regulatory clarity improves, we could see a wider adoption of DeFi services, not just by crypto enthusiasts, but by everyday consumers and businesses.

- Integration with Traditional Finance: We might also see a hybrid model emerge, where traditional banks and financial institutions adopt blockchain technology to offer decentralized services. This could lead to more efficient financial systems and a reduction in banking fees.

- New Financial Products: The innovation in DeFi will continue to expand beyond lending and trading. We could see new decentralized derivatives markets, tokenized real estate, and even decentralized pension systems in the future.

Conclusion

The rise of Decentralized Finance (DeFi) is more than just a technological breakthrough—it’s a movement that we truly believe in. We’ve spent years diving into this space, exploring its endless possibilities, and witnessing how it empowers people from all walks of life to take control of their finances. This is more than just a passing trend. It’s the future of finance, and it’s already changing the lives of people who would otherwise be left out of the traditional banking system.

We both remember the moment we realized how much potential DeFi has. It wasn’t just about earning higher yields or avoiding the bureaucracy of banks. It was about understanding that the traditional financial system, with all its gatekeepers, high fees, and limitations, isn’t the only option anymore. DeFi opens the door to a world where you have more control, more transparency, and more opportunities.

For us, this journey is personal. We’ve seen friends and colleagues who didn’t have access to traditional banking, or who were frustrated with how slow and costly it was to send money across borders, find solutions in DeFi. It’s inspiring to see how quickly things are evolving, and we’re both committed to being part of that change. We want to help others understand the power and potential of decentralized finance so they too can take advantage of these innovations.

DeFi isn’t just for tech experts or crypto enthusiasts. It’s for anyone who wants to rethink how they save, invest, and manage money. It’s about making finance more accessible, more inclusive, and more transparent. And while there are still risks and challenges to be aware of, the growth of this space is undeniable.

If you’re feeling overwhelmed by all the possibilities, don’t worry—you’re not alone. We’ve both been there. But we can assure you that taking the time to explore DeFi is worth it. Start small, experiment with lending platforms, try out decentralized exchanges, and slowly get comfortable with how everything works. Each step you take will bring you closer to a new financial frontier.

Our advice? Stay curious, stay informed, and be open to learning. The DeFi space is growing fast, and there’s so much more to come. We’re thrilled to share this journey with you, and we’re here to help guide you along the way. Whether it’s finding better ways to save and invest, or simply understanding how DeFi can fit into your life, we’re excited about the future of finance and the opportunities it will bring.

The world of decentralized finance is just beginning to unfold, and you have the chance to be part of something truly transformative. We’re excited for what lies ahead, and we hope you’ll join us on this adventure.

Ty,

Team #CodeIsLaw